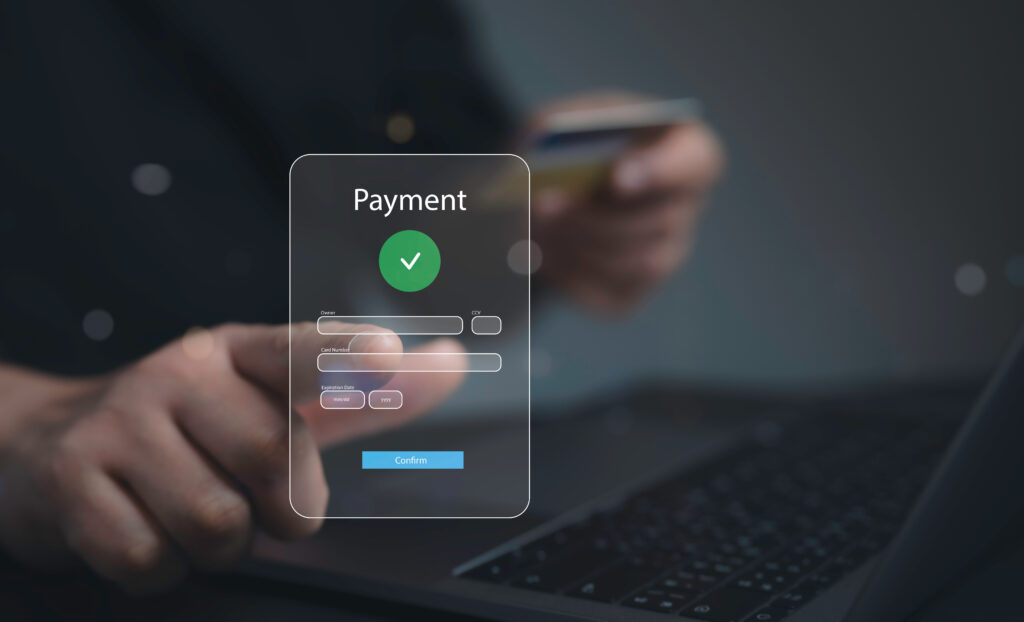

Customers like it,

you’ll love it

ACH (Automated Clearing House) payments, also known as electronic checks or e-checks, offer a seamless way to transfer funds between bank accounts without the need for paper checks or wire transfers. With this solution, you can meet growing consumer demand and enjoy noticeable benefits to your business.

ACH/Electronic Check Benefits

Faster funds

Process payments at the time of sale, eliminating the wait for checks in the mail.

Reduced costs

Save time, labor, and mailing fees associated with paper invoices.

Enhanced efficiency

Set up recurring payments to save time and ensure more consistent cash flow.

Better security

You can use a secure web-based virtual terminal with advanced features like encrypted vaults for sensitive data.

Great customer experience

Offer flexible payment options including one-time and recurring payments, along with customizable receipts and payment pages to meet diverse customer needs.

Software developers, we help you too

Stand out from the crowd

Integrate seamless payment processing to differentiate your software from competitors and offer a complete solution.

Boost customer growth & retention

Increase customer acquisition and retention by offering payment processing as a complementary product.

Enhance product value

Elevate the perceived value of your product by offering merchants access to modern payment tools and experiences.

What our Customers have to say

Sarena Hansel, Controller

Propane Depot Inc.